is yearly property tax included in mortgage

However there are some times when this is not. Ad Highest Satisfaction for Mortgage Origination.

Pay Property Tax Online Property Tax What Is Education Reverse Mortgage

The amount you owe in property taxes is fairly easy to calculate.

. Mortgages typically specifically define real estate taxes as the responsibility of the owner. Each year youll have to pay property taxes on your home. Youll just need some information.

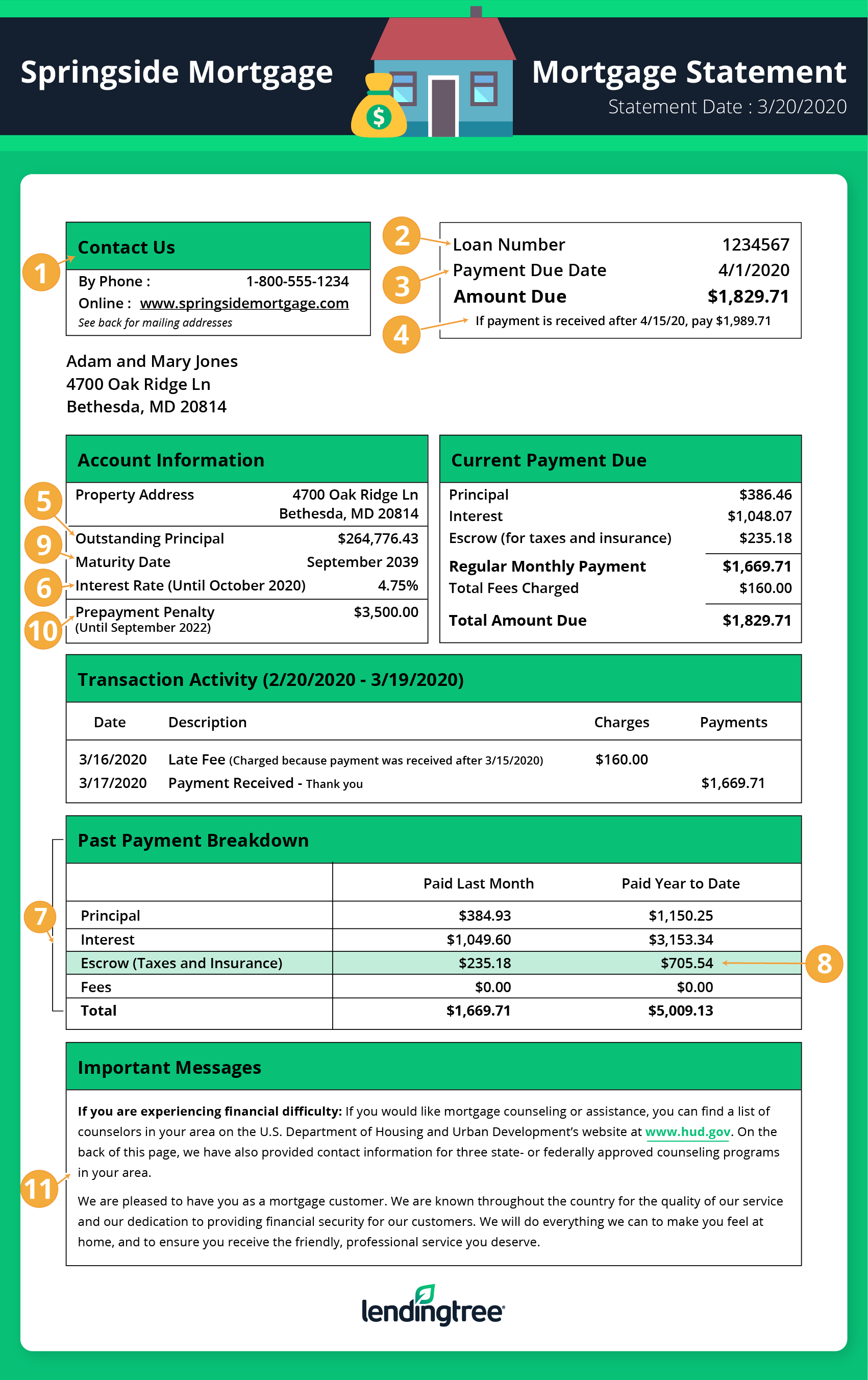

Compare Rates Get Your Quote Online Now. Answer 1 of 3. The second way to determine if your mortgage will or will not be paying those taxes for you is to study your monthly mortgage statement.

Ongoing costs include your. Property taxes are based on the assessed value of the home. Calculate Individual Tax Amounts.

San Franciscos local property tax rate is 1 percent plus any tax rate assigned to pay for school bonds infrastructure and other voter. Homeowners insurance is not included in your mortgage its an insurance policy thats completely separate from your loan agreement. I think the correct term is EMI not mortgage No banks will not pay the property tax The monthly installments you pay the bank does not include the property tax.

Your property assessment can change as well so you may not pay the same amount in taxes every year. Ad Americas 1 Online Lender. Most of the time your lender will collect property tax in your mortgage payment then pay your municipality on your behalf.

Real property or real estate is taxed at a rate determined by the taxing authority. Mobile home taxes can be classified a couple of different ways depending on the land beneath the home. While your local government charges property taxes every year you can pay them as part of your monthly mortgage payment.

Most likely your taxes will be included in your monthly mortgage payments. Lenders operate on the assumption. Every month you pay a portion of your property.

As your lender shared with you during the financing process there are homeownership costs beyond your mortgage payment that require your attention. Answer 1 of 4. Most of these costs are due.

If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment make sure you dont treat the entire payment. Lenders often require you to pay for. Usually the lender determines how much property tax you pay each month by dividing the yearly estimated amount by 12.

Several factors influence this including notably the value of comparable properties in the area and condition. While this may make your payments larger itll allow you to avoid paying a thousand dollars or more in one sitting. You may have to pay up to six months worth of property taxes and maybe even a years worth of insurance up front.

Thats because in most cases it is your mortgage lender who takes care of paying out your property taxes either from funds collected in escrow or from your monthly mortgage. Apply Online To Enjoy A Service. Your property taxes are usually included in your monthly mortgage.

Property taxes can vary widely depending on where your home is located. The property tax percentage for your area. The mortgage company may offer.

Look in the total payment- It will show you the. The vast majority of homeowners pay property taxes in monthly installments to their mortgage lenders who make the requisite tax payments to the county. Are real estate taxes included in a mortgage.

Find the Best Mortgage Lender for You. Its almost inevitable that home taxes will be included in your mortgage payment if you finance more than 80 percent of your homes value. Escrow accounts are set up to collect property tax and.

This is added to your monthly mortgage payment. Lenders commonly require this if. Ad Mortgage Loans Low APR Top Lenders Comparison Free Online Offers.

The assessed value of the home.

Lending Vocab Cheat Sheet Conifer Realty Group Home Mortgage First Time Home Buyers Mortgage Tips

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

Understanding Your Property Tax Bill Clackamas County

Florida Property Tax H R Block

What Is Florida County Real Estate Tax Property Tax

Mortgage Calculator With Amortization Schedule Extra Monthly Payments Insurance And Hoa Included Mortgage Calculator Mortgage Fha Mortgage

The Property Taxes And Insurance Are Variables That Contribute To The Total Payment Property Tax Property Home Hacks

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

What Is A Homestead Exemption And How Does It Work Lendingtree

Mortgage Escrow What You Need To Know Forbes Advisor

How To Read A Monthly Mortgage Statement Lendingtree

Buying A Home Isn T Just A Possible 20 Down Payment And A Monthly Check For The Mortgage There Are A M Home Buying Buying Your First Home Home Buying Process

Mortgage The Components Of A Mortgage Payment Wells Fargo

Property Tax How To Calculate Local Considerations

Home Buying Guide 101 Step Two 3 4 These Two Simple Rules Will Show You What You Can Afford To Mortgage Payment Home Buying House Cost

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate